In recent years, there has been a significant increase in the number of homeowners and businesses turning to solar power as an efficient and cost-effective energy source. However, the initial investment required for solar installation can be substantial, making it seem out of reach for many individuals and entities. Fortunately, governments around the world recognize the significance of promoting renewable energy use and have implemented various incentives and tax credits to make solar power more accessible and affordable. These tax credit programs offer a range of benefits for homeowners and businesses who want to invest in solar power technology. Many of these benefits include significant savings on energy bills, reduced carbon footprint, and an increase in property value. In this blog post, we will take a closer look at the benefits of solar tax credits for both homeowners and businesses. We will examine various solar tax credits programs available and how you can apply for them. For a comprehensive understanding of solar tax credits, it’s worth visit the website that offers A Homeowner’s Guide to Solar Tax Credits.

Contents

1. Tax credits for investing in solar energy

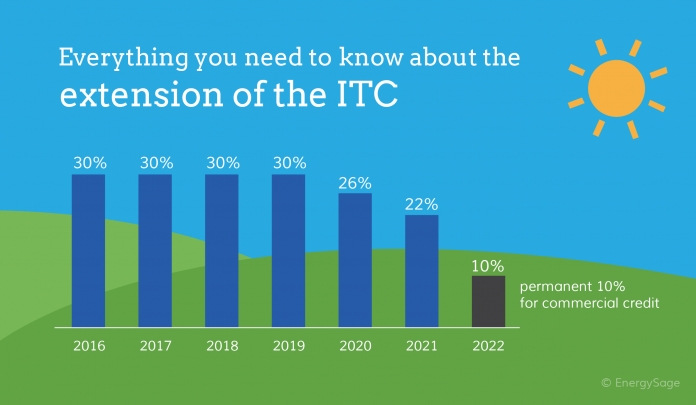

One of the key benefits of solar energy systems is the tax credits available for homeowners and businesses that invest in them. The government offers a federal tax credit that covers up to 26% of the cost of a solar system installation for both residential and commercial properties. This tax credit allows homeowners and businesses to reduce their tax liability, thus serving as an incentive to invest in solar energy. In addition, some states offer their own tax credits and incentives for solar energy systems, further reducing the overall cost of installation. The savings alone from tax credits can make investing in solar energy an attractive option for those looking to reduce their energy bills and environmental impact.

2. Reduction in electricity costs

One significant benefit of solar tax credits for homeowners and businesses lies in the reduction of electricity costs. By generating your electricity through the installation of a solar panel system, you can greatly reduce your reliance on traditional power grids supplied by utility companies. Not only does this translate into a more environmentally sustainable energy source, but it also can translate into significant savings on your monthly utility bills. By generating more energy than your household or business consumes, you can even qualify for net metering, which allows you to earn credits on your utility bill for the excess energy you generate. The availability of solar tax credits to offset the initial installation costs only further incentivizes potential adopters and provides additional savings in the long run. Overall, the reduction in electricity costs is a powerful motivator for the widespread adoption of solar panel systems and the use of solar tax credits to do so.

3. Increased home/business value

One of the significant benefits of solar tax credits for homeowners and businesses is the potential to increase property value. According to research, homes and commercial buildings with solar panels installed can have higher resale values and attract more buyers compared to those without solar power. This is because solar energy has become increasingly popular in recent years, and many individuals and businesses prefer environmentally-friendly options. A property with installed solar panels can also reduce energy costs, making it more cost-efficient and attractive to potential buyers. Home and business owners who invest in solar can significantly enhance their property values and potentially make a profit when they sell their property.

4. Positive environmental impact

A significant benefit of investing in solar panels is the positive environmental impact. Solar energy is a clean, renewable source of energy that produces no greenhouse gas emissions or air pollution. By using solar power, homeowners and businesses can greatly reduce their carbon footprint and help to combat climate change. The adoption of solar energy systems also contributes to reducing our dependence on nonrenewable energy sources like fossil fuels. Additionally, investing in solar panels helps to promote sustainable energy practices, which can help to preserve natural resources and protect the environment for future generations. These factors make solar energy an excellent option for anyone who wants to make a positive impact on the environment while saving money on their energy bills.

5. Revenue generation for governments

One of the most significant benefits of solar tax credits is revenue generation for governments. Through the implementation of tax credits for the purchase and installation of solar power systems, governments can create positive economic impacts by encouraging widespread adoption of renewable energy sources. As more homeowners and businesses invest in solar power, governments can collect additional tax revenues, fueling local economies and creating new jobs. In addition, the installation of solar power systems can also reduce the need for costly infrastructure upgrades associated with traditional energy sources, further saving governments money in the long run. All in all, the revenue generation potential of solar tax credits makes them a valuable tool for promoting sustainable and economically beneficial practices.

Conclusion

Solar tax credits for homeowners and businesses are an attractive incentive to promote the use of solar energy. They not only help to reduce the costs associated with the installation of solar panels but also contribute to the country’s clean energy goals and mitigate climate change. While these tax credits may eventually expire, they provide an excellent opportunity to jumpstart the adoption of solar energy and serve as a reminder that we have a shared responsibility to ensure a better future for the planet.